Alert: Minnesota Public Benefit Corporation Act - Who Will Measure the Benefit, and How?

On January 1, 2015, the Minnesota Public Benefit Corporation Act (the Act) takes effect, and will allow the formation of public benefit corporations for the first time in this state. Public benefit corporations are not charitable or tax-exempt—they are commercial enterprises at their core—but in addition to general business purposes, they are formed to benefit the public and designed to operate in a socially responsible and sustainable manner. In short, the form accommodates both a public mission and private commercial ambition.

But how does the Act define “public benefit,” and how will the public be assured that any particular public benefit corporation has earned the use of that name? The answer to the first question is that the Act does not define “public benefit,” at least not directly; and the answer to the second question is that the general public will not have any legal standing to ensure that public benefit corporations are operated for the public good. Many readers may be surprised by that fact. However, the purpose of the Act is not to confer any preferential tax treatment on public benefit corporations, which would be the primary policy reason for stricter regulation.

Rather, the intent of the Act is more modest: (a) to allow companies to publicly declare that they will be operated for some defined set of purposes beyond pecuniary gain; (b) to protect directors who consider those additional purposes; (c) to attract and empower like-minded investors; and (d) to gain a reputational lift among publicly minded consumers.

Consequently, the Act’s oversight approach is to require public transparency through annual benefit reports, but also to reserve to shareholders the ability to maintain a lawsuit alleging failure to deliver the promised public benefit.

Defining Public Benefit

Upon incorporation or, for existing business corporations, election of public benefit status, a public benefit corporation must identify itself in its articles of incorporation as either a “general benefit corporation” or “specific benefit corporation.”

A general benefit corporation (GBC) is organized and operated to pursue general public purposes; however, a general benefit corporation may, in addition, elect to define and pursue one or more specific public benefit purposes.

A specific benefit corporation (SBC) is organized and operated to pursue one or more company-defined specific public benefit purposes. The Act explicitly provides that a corporation that chooses a specific benefit purpose does not, by doing so, obligate itself to also pursue general public benefit.

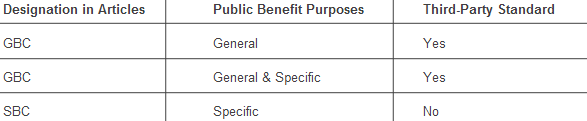

It follows that there are actually three possible permutations of Minnesota public benefit corporations, which may be defined by reference to their reporting requirements (discussed below):

Third-Party Standard for General Benefit Corporations

As shown in the table above, if a corporation chooses general benefit corporation status, its board of directors must also identify an independent third-party standard against which to measure the corporation’s public benefit. No particular standard is required by the Act, nor does the Act require that the general benefit corporation be audited, accredited, certified, or otherwise reviewed by the organization that promulgates the selected third-party standard. The Act merely requires that the third-party standard be “a publicly available standard or guideline for defining, reporting, and assessing the performance of a business enterprise as a social or benefit corporation” that is promulgated by a person or organization independent of the public benefit corporation. Many organizations publish such standards, including B Lab, Ceres, Global Reporting Initiative, ISO International, Underwriters Laboratories, and others.

Accountability Under the Act

Reporting

Both GBCs and SBCs are obligated to file an annual benefit report with the Minnesota Secretary of State, due each year within 90 days of the end of the calendar year. The chief executive officer of the corporation must sign the report. The contents of the report vary by type of public benefit corporation.

A general benefit corporation must—

1. Identify an independent third-party standard (described above);

2. Certify that its board of directors has selected such standard and reviewed and approved the annual benefit report; and

3. For the period covered by the report, with respect to the third-party standard, describe:

a. how the corporation has pursued general public benefit;

b. the extent to which and the ways in which the corporation has created general public benefit; and

c. any circumstances that hindered efforts to pursue or create general public benefit.

Additionally, the first report delivered for filing by the general benefit corporation must explain why the board of directors chose the third-party standard it did. In subsequent years, if the third-party standard remains the same, the report must state whether the standard is being consistently applied, and if it is not, why not. The board may decide to change to a different third-party standard in any subsequent year; however, if it does so, it must explain why and how the board chose the new standard.

If the general benefit corporation has stated one or more specific benefit purposes in its articles of incorporation, it must also report the same information that specific benefit corporations are required to report (described below).

A specific benefit corporation must—

1. Certify that its board of directors has reviewed and approved the annual benefit report; and

2. For the period covered by the report, describe:

a. how the corporation has pursued and created the specific public benefit it chose to incorporate into its articles;

b. the extent to which and the ways in which that specific benefit was created; and

c. any circumstances that hindered efforts to pursue or create the specific public benefit.

Failure to File an Annual Benefit Report

If a public benefit corporation fails to file an annual benefit report within 90 days of the due date, the Act provides that the Secretary of State shall revoke the corporation’s status as a public benefit corporation and must notify the public benefit corporation of the action. As of the date of revocation of the status as a public benefit corporation, a corporation is no longer entitled to any of the benefits provided by the statute—perhaps most notably, the ability to hold itself out publicly as a GBC or SBC. If a public benefit corporation files a renewal (which must include the required annual report) and pays a $500 fee within 30 days of the issuance of the revocation, the Secretary of State will reinstate the corporation as a public benefit corporation retroactive to the date of revocation.

If a corporation’s status as a public benefit corporation is revoked due to an intentional failure to file an annual benefit report, the Act provides that a shareholder of the public benefit corporation who objects to such intentional failure may obtain payment for the fair value of his or her shares.

Legal Claims Against a Public Benefit Corporation for Failure to Pursue Public Benefit

As indicated above, the Act reserves to shareholders—not any member of the general public—legal standing to sue a public benefit corporation or its officers for failure to create or pursue a general or specific public benefit. Further, a public benefit corporation is not liable for monetary damages for failing to pursue or create a general or specific public benefit, though the court may grant any equitable relief it deems just and reasonable.

Shareholders may maintain a suit against a public benefit corporation on any of the grounds provided in the Minnesota Business Corporation Act. In addition to those grounds, a court may grant relief when:

1. Directors or those in control of a public benefit corporation have—to a substantial extent and in a sustained manner—breached their duty to consider the effects of any proposed or actual conduct on the corporation’s ability to pursue or create the general or specific benefits it is committed to pursue; or

2. The public benefit corporation has for an unreasonably long period of time failed to pursue public benefit.

If a lawsuit is brought under the Act, then in addition to granting any other equitable relief the court determines is just and reasonable under the circumstances, and in addition to any relief available under the Minnesota Business Corporation Act, the court may:

1. Order the public benefit corporation to terminate its status as a public benefit corporation.

2. Remove one or more directors from the public benefit corporation’s board and determine how the vacancy will be filled; and/or

3. Appoint a receiver of the public benefit corporation to either wind up and liquidate the business and activities of the corporation or to carry on its business and activities in a manner consistent with the Act.

* * *

Please keep an eye out for future nonprofit alerts from Gray Plant Mooty on public benefit corporations. Read our previous alerts for general information about the Minnesota Public Benefit Corporation Act or click here to find out what you can do now to prepare for public benefit corporation status effective January 1, 2015.

If you have any questions about the Minnesota Public Benefit Corporation Act, please contact Greg Larson (greg.larson@lathropgpm.com, 612.632.3276) or Catherine Bitzan Amundsen (catherine.amundsen@lathropgpm.com, 612.632.3277).